7 Plan Performance

- Movement of containers and how the money flows through the Return-It network

- Revenue and expenditure detail.

- Purpose of operating reserves, how they are determined and why they’re important.

- Container recycling fees by product type.

7.1 How Money Flows

The arrows show the direction of payments for deposits and container recycling fees (CRFs) and the movement of beverage containers.

7.2 Follow the Money

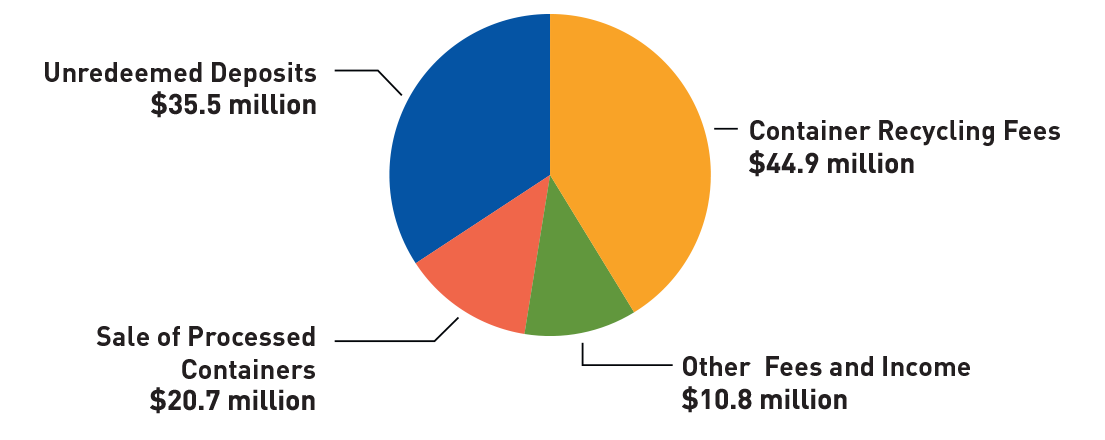

Revenues

Container Recycling Fees

When the revenue from unclaimed deposits and from sales of collected material is insufficient to cover the cost of recovering and recycling a specific container type, a non-refundable recycling fee is added to the container to make up for the shortfall.

Other Fees

Revenues and income from service provider contracts.

Sale of Processed Containers

A portion of the cost of recovering aluminum and plastic containers, the two largest categories, is covered by the value of the commodity collected. The prices for aluminum and plastic were very strong in 2021, resulting in substantially higher commodity revenue compared to the original forecast. The higher-than-forecasted prices for aluminum (33% higher than in 2020) and plastic (200% higher than in 2020), combined with the increase in sales and units recovered for those two container categories, contributed to the increase in our operating reserves in 2021.

Unredeemed Deposits

Encorp is paid a deposit on every container sold. Deposits unclaimed are used to fund the system.

| Container Recycling Fees | $44.9 million | 40.1% |

| Other Fees and Income* | 10.8 million | 9.7% |

| Sale of Processed Containers | 20.7 million | 18.5% |

| Unredeemed Deposits | 35.5 million | 31.6% |

| Total Revenues | 111.9 million | 100% |

Note: Calculations may show slight variances due to rounding.

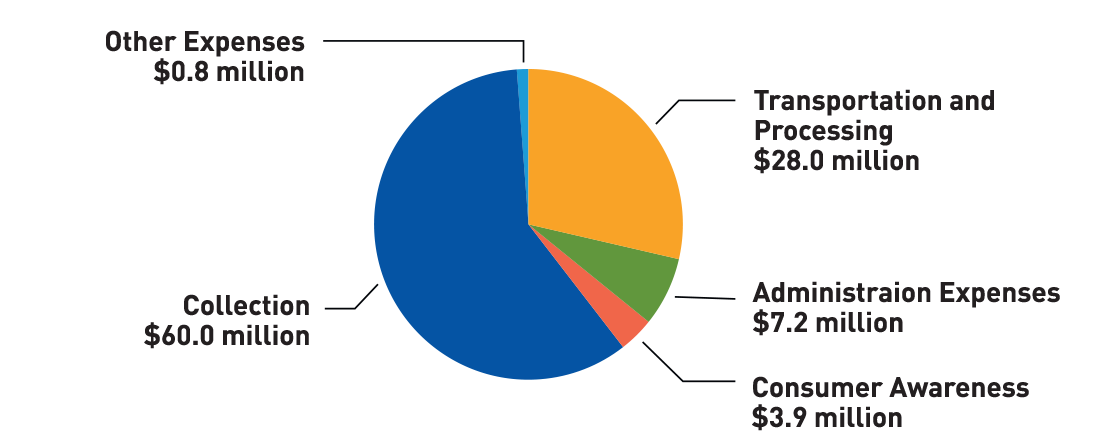

Expenditures

Deposit Refunds

Paid to depots and grocery retailers to reimburse them for the deposits they have refunded to consumers.

Operations Expenses

Operating expenses make up 88.1% of our overall expenditures in 2021 and are broken down into two categories.

Collection Expenditures

Encorp’s single-largest expense is the cost of collection that includes handling fees paid to contracted, independently owned Return-It depots that service customers, collect the material and prepare the material for collection by Encorp’s transportation partners. In 2021, handling fees accounted for 96% of the total collection cost of used beverage containers.

Transportation and Processing

Encorp contracts with various trucking companies to collect containers from depots and grocery retailers and deliver them to our contracted processing partners, where they are processed, sorted and compacted for shipment to end markets. For these services, Encorp pays them transportation fees, fuel and processing fees.

Administration

Management of contracts, collection of revenues and payment of expenses.

Consumer Education and Awareness

Programs that encourage consumers to return containers for recycling.

| Collection | $60.0 million | 60.1% |

| Transportation and Processing | 28.0 million | 28.0% |

| Administration Expenses | 7.2 million | 7.2% |

| Consumer Awareness | 3.9 million | 3.9% |

| Other Expenses** | 0.8 million | 0.8% |

| Total Expenditures | 99.9 million | 100% |

7.3 Operating Reserves

Purpose of the Operating Reserves

Encorp’s reserves are built upon the corporation’s fundamental principles of no cross-subsidization of container types and equitable treatment of brand owners. The operating reserves are required to provide stability to the system over the long term, to avoid cross-subsidization of container types, and to facilitate and stabilize the frequency of container recycling fee (CRF) changes.

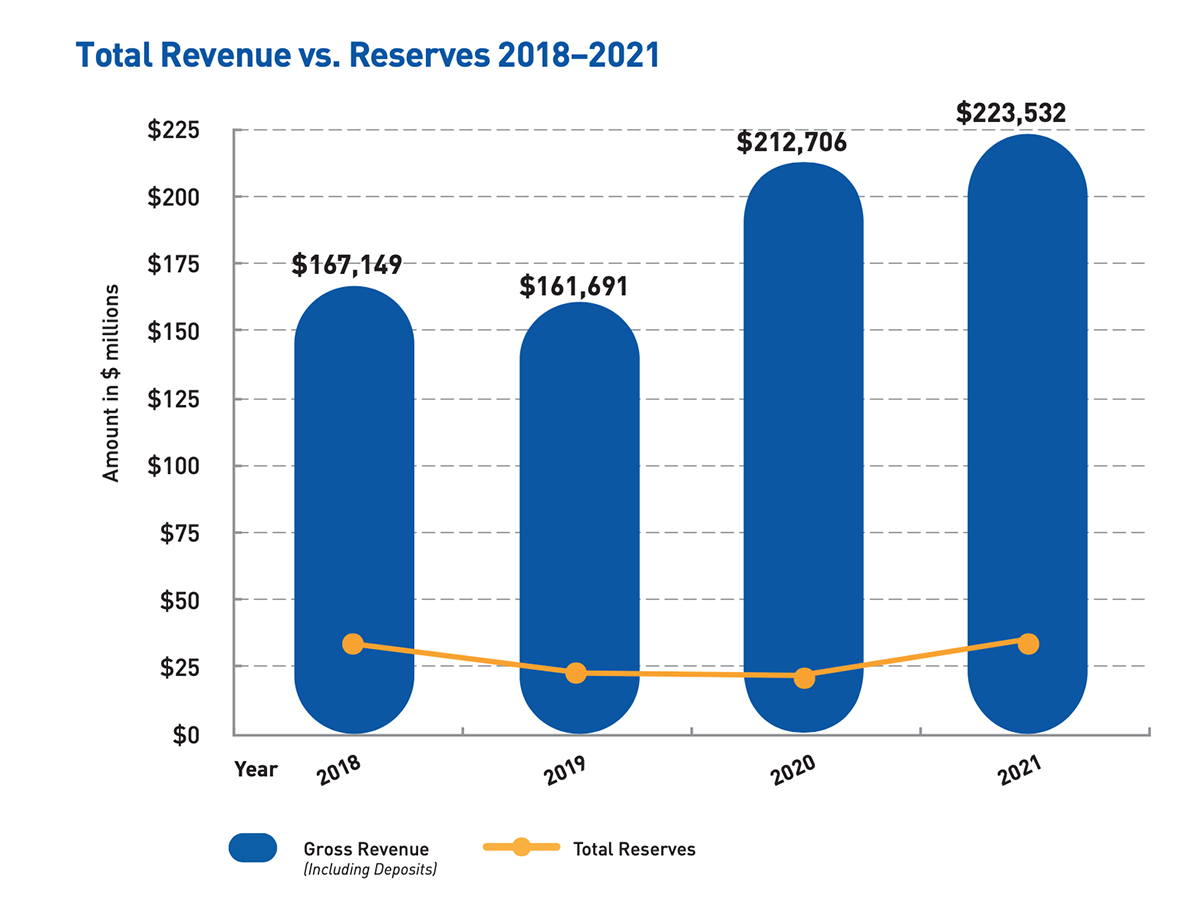

CRFs may be raised, reduced or even eliminated in any given year to keep reserves within their targeted ranges. Reserves can also be reduced by increasing spending on activities designed to improve the recovery rate for a specific container type. The table shows the levels of reserves over recent years.

Management of the Operating Reserves

Encorp’s financial model requires a reasonable level of operating reserves to provide stability to the system and to ensure that stable program operations continue through variable economic conditions. When these reserves rise above the targeted reserve range, measures are taken to reduce them to the appropriate level.

Encorp’s operating reserves are maintained to meet the corporation’s cash flow requirements, recognizing normal business volatility balanced over a period of three to five years.

This year, the net assets of the company increased by $12 million for a total balance of $35 million. The net assets include a $5.1 million investment in capital assets, $7.5 million in internally restricted reserves and $22.4 million in operating reserves. The operating reserves are required to support weekly payments to customers, depots, transporters and processors during six weeks of the peak season.

7.4 Container Recycling Fees

CRF stands for Container Recycling Fee. This is the fee Encorp charges to cover the net cost of recycling a beverage container type after any unredeemed deposits and commodity revenues for that container type have been used.

CRFs have been in place for beverage containers in British Columbia for more than 18 years. The CRF varies for each beverage container category. As a not-for-profit product stewardship agency, Encorp Pacific only charges the net cost for recovering and recycling beverage containers. The CRF reflects current economic conditions such as commodity prices and beverage volumes.